According to new data from Lloyds Bank* spend on debit cards made in person, using contactless technology, has grown from 65% to 87% in the last three years.

In April 2020 – during the pandemic – the contactless limit was increased from £30 to £45, rising to £100 in October 2021.

These higher limits have helped cement contactless as the preferred payment method of customers when out and about.

Contactless convenience

Contactless convenience

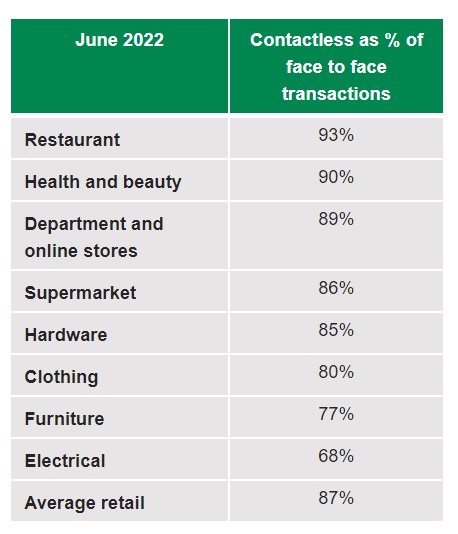

The rise in contactless payments as a preferred method has been driven by restaurant and health and beauty purchases, which both see around 90% of face to face card payments made with a tap of a debit card.

While all categories analysed see contactless as the main choice for debit card spending, this does start to tail off for retailers where the average purchase price is typically over £100 (and therefore contactless would not be available), such as furniture stores or electrical stores.

In response to customer feedback, Lloyds Bank was the first bank to allow customers to choose their own contactless limit for spending, between £30 and £95, on a debit or credit card.

Since this feature was introduced in autumn 2021, 800,000 debit card customers have used it to freeze contactless payments, or choose an alternative limit.

Over half (60%) of debit card customers who have set their own limit have opted for one under £50.

A further quarter (25%) have set the highest bespoke limit of £95.

Gabby Collins, Payments Director, Lloyds Bank, said: “The convenience of a contactless payment is clear when you look at the growth in this type of payment over time, with 87% of face to face debit card transactions now made using the technology. We know how important choice is for customers, so our mobile app gives customers the option to set their own contactless limit, as well as turn the option on and off, and we’ve seen around 800,000 customers use the tool since we introduced it in 2021.”