Every business will experience ‘bumps in the road’ as they look to invest and grow. The bumps come is various shapes and sizes but they all have something in common – each one has the potential to cause cash flow problems.

There is an old adage – ‘Turnover is vanity, profit is sanity and cash flow is king’. If you fall into what’s known as the ‘cash flow trap’, it doesn’t matter how profitable you are, you will be in danger of going out of business.

Inevitably, some of these bumps have become more severe since the arrival of COVID-19.

Over the past few years, Just Cashflow has dealt with many thousands of businesses and we are well positioned to identify what the top five most common bumps are.

The sudden arrival of large bills that have to be paid almost immediately feature strongly in our top five Some of the largest bills that businesses have to plan for are large

VAT, PAYE and Corporation Tax bills. Many businesses make the mistake of not diarising when these need paying and there is little tolerance for the inability to pay.

This is extremely topical because of the COVID-19 crisis relegated deferment of VAT payments between 20th March and 30th – providing SMEs with some valuable breathing space. However, using this money to cover cash flow issues is only storing up trouble for the future as the VAT has to be repaid by 31st March 2021 so you need a plan to ensure you will have that cash available.

You have no option but to pay up on time so it’s good advice to set up a separate deposit account. Work out your average VAT, PAYE and Corporation Tax for the previous year. Divide it by 12 and set up a standing order for that amount to go out monthly from your current account to the deposit account. This money will give you peace of mind when the tax bills arrive. If you find you need to dip in to your deposit account then you know you have cash flow issues.

One option, when faced with large bills, is to look for short term finance but you are then in danger of making a rash decision, not having time to do your research and signing up for the wrong facility.

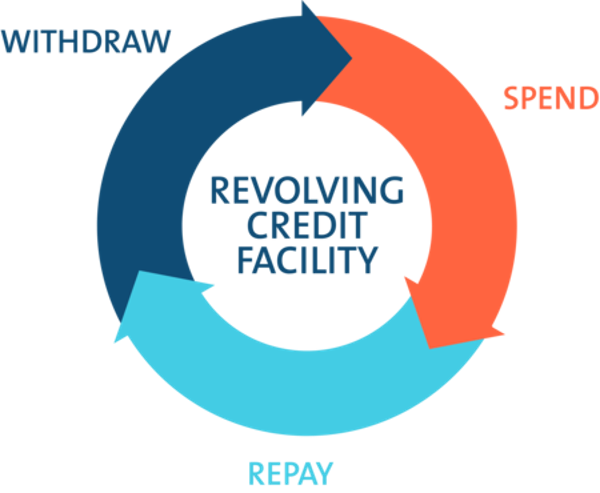

Alternative lenders such as Just Cashflow have recognised this and we have introduced our Revolving Credit Facility that works exactly in the same way as a bank overdraft and allows growing companies to smooth out the peaks and troughs.

Interest is charged on a daily basis and there is no long-term commitment, so it provides complete flexibility for the borrower.

You can contact Just CashFlow via their website www.just-cashflow.com or call them directly +44 (0)121 4185795