UKEF and K-Sure have secured support worth £367 million for South Korean manufacturer SeAH Steel Holding’s construction of a wind tech factory near Redcar, in the Tees Valley. In a groundbreaking collaboration, UK Export Finance (UKEF) and South Korea’s export credit agency, Korea Trade Insurance Corporation (K-Sure), have played a pivotal role in securing financing from Standard Chartered Bank and HSBC UK for the construction of the world’s largest wind monopile manufacturing facility by SeAH Wind UK.

UKEF and K-Sure have secured support worth £367 million for South Korean manufacturer SeAH Steel Holding’s construction of a wind tech factory near Redcar, in the Tees Valley. This transaction supports the creation of up to 750 jobs by 2027, cementing the North-East’s place as a centre of expertise and employment for renewable energy. Additionally, this marks UKEF’s first-ever guarantee for inward investment issued under its ‘Invest-to-Export’ Export Development Guarantee product, signalling the availability of multimillion-pound support for companies investing in new UK exporting opportunities. Moreover, it is the first joint financing between UKEF and K-Sure for a UK investment by a Korean company.

Lord Offord, Minister for Exports, emphasised, “This landmark deal brings substantial overseas investment to Teesside and consolidates the UK’s place as a world leader in offshore wind – and renewable energy – expertise and exporting. Through UK Export Finance, this government is bringing in new investment for the UK’s world-class manufacturing sector and securing the long-term prosperity of the United Kingdom.”

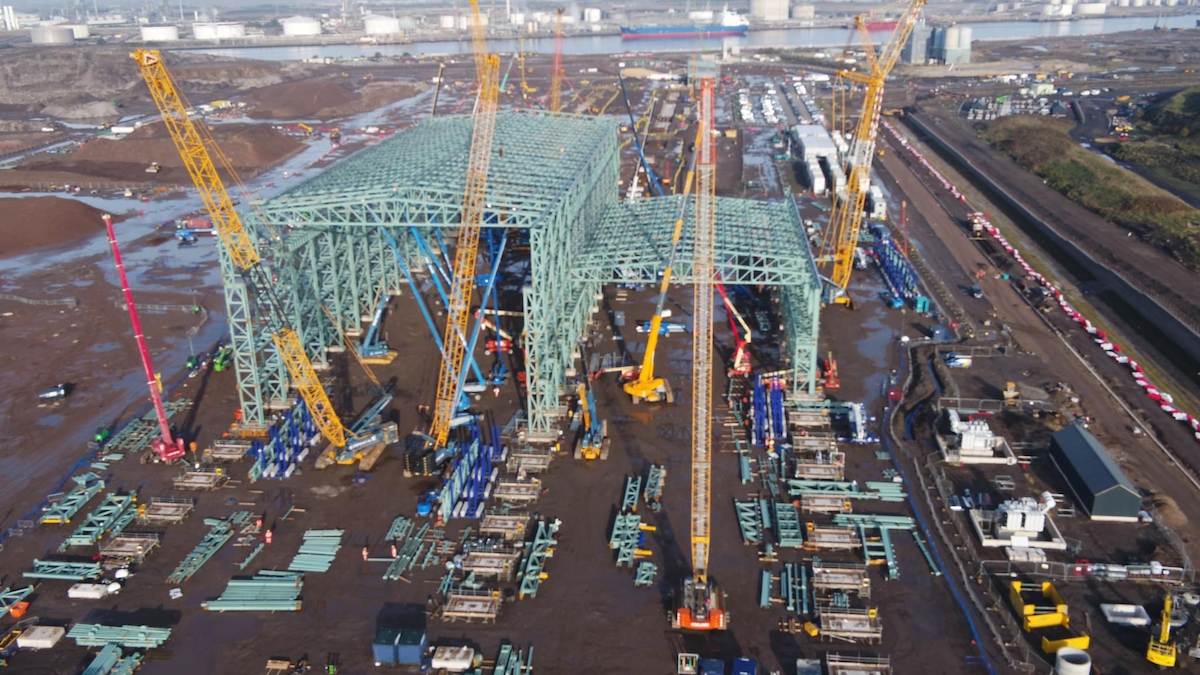

The financing will secure inward investment, creating 750 jobs in Teesside and ensuring the construction of the world’s largest wind monopile factory in Redcar. Issuing its first-ever ‘Invest-to-Export’ loan guarantee to secure overseas investment in British industry, UKEF together with K-Sure has ensured that SeAH Wind UK can fund the construction project – worth almost £500 million – with £367 million in financing from Standard Chartered Bank and HSBC UK. The facility was also eligible for longer and more flexible repayment terms as a ‘Clean-Growth’ facility. Wind monopiles act as the foundation for most offshore wind turbines and are critical to the growth of the global renewable energy sector.

Yoshi Ichikawa, Head of Structured Export Finance for Europe at Standard Chartered, expressed pride in contributing to the UK supply chain and accelerating the transition to net zero. Philip Lewis, Global Co-Head of Export Finance for HSBC, highlighted the importance of supporting SeAH Wind in meeting the rising demand for renewable energy.

SeAH Wind UK, a subsidiary of South Korean steel company SeAH Steel Holding, announced its decision to invest and broke ground at Teesworks Freeport last summer. The confirmed support, now being announced, will secure the project’s future. The £367 million financing comprises £257 million supported by UKEF and £110 million supported by K-Sure. This deal creates British jobs and cements Teesside’s place as a centre of manufacturing expertise for renewable energy.

Chris Sohn, SeAH Wind, expressed delight in investing in the UK, emphasizing the project’s contribution to the growth of the UK’s local economy and global decarbonization efforts. The aim is to become a global leader in the offshore wind supply chain. The company expressed gratitude to UKEF and K-Sure for their support.

Upon completion of the factory, SeAH Wind UK will export monopiles to US and European markets, creating up to 750 jobs by 2027 and supporting more than 1,500 jobs in the wider supply chain. The ongoing construction has already secured a deal worth over £100 million for British Steel and will create opportunities for the UK supply chain in sectors like manufacturing, construction, and logistics. UKEF’s support was provided under the Export Development Guarantee (EDG) product, which supports UK companies looking to bolster their exporting capability. Today’s news highlights the availability of UKEF support for both UK and overseas companies seeking to invest in new export opportunities, with financing available based on the applicant’s potential for winning overseas orders.